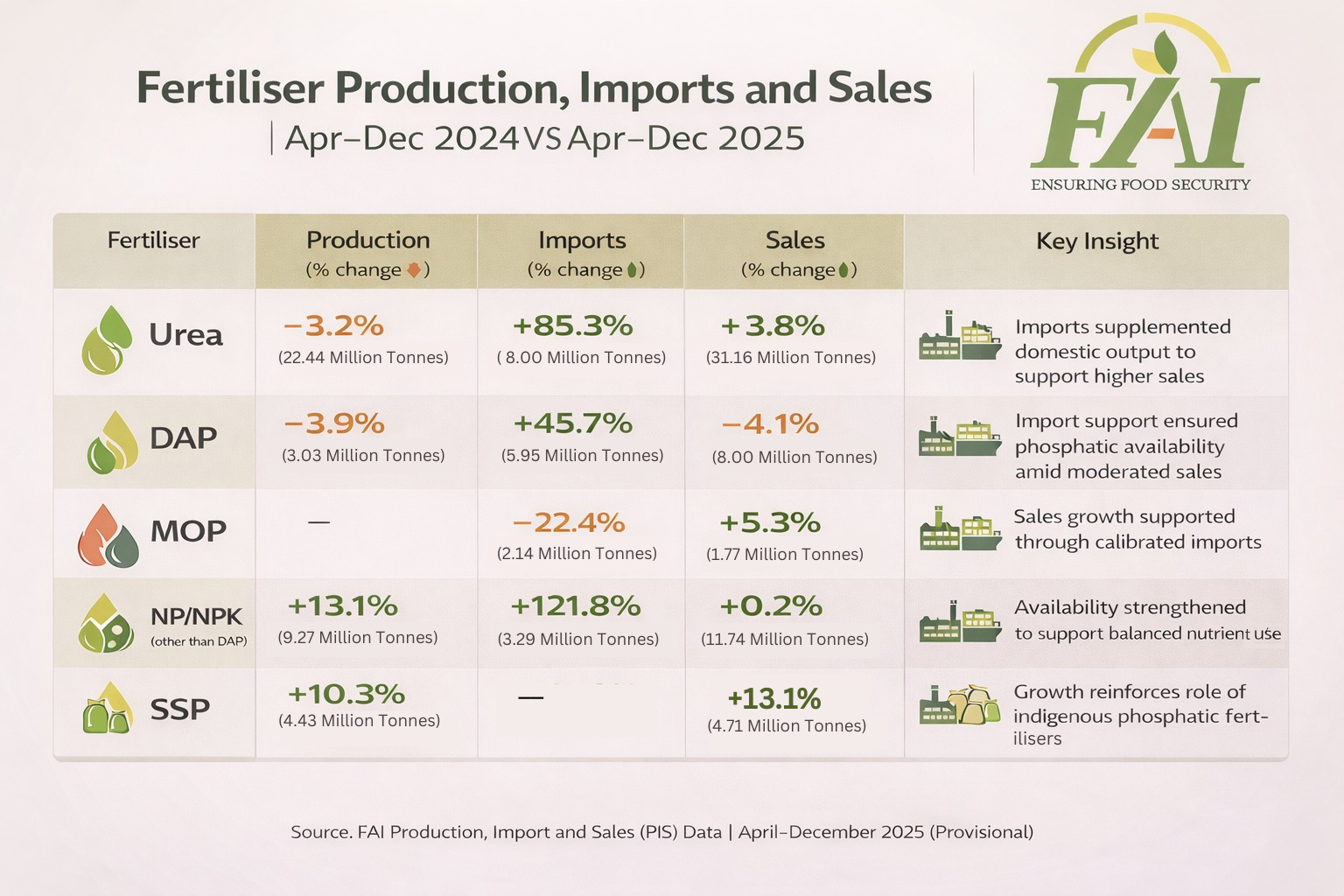

Mumbai, Jan 28: The Fertiliser Association of India (FAI) provisional data on fertiliser production, imports and sales for April–December 2025, covering major fertilisers including urea, DAP, MOP, complex fertilisers and Single Super Phosphate (SSP) are available. The data captures both cumulative trends over the fertiliser year to date and recent movements during the Rabi season, reflecting coordinated supply planning through domestic production and calibrated imports to support fertiliser availability.

COMPLEX FERTILISERS (NP/NPK): Availability Strengthened to Support Balanced Nutrition

During April–December 2025, production of NP and NPK fertilisers (other than DAP) rose 13.1% to 9.27 million tonnes, with imports increasing 121.8% to 3.29 million tonnes, even as sales remained largely stable at 11.74 million tonnes. The data points to a deliberate strengthening of complex fertiliser availability, enabling balanced nutrient use across cropping patterns without reliance on short-term demand fluctuations.

“The April–December 2025 data shows how the fertiliser sector has worked to keep nutrients available through a balance of domestic production and calibrated imports,” said Mr. S. Sankarasubramanian, Chairman, FAI. “Maintaining stable supply across nutrients during the fertiliser year, including the rabi season, is central to ensuring that farmers have timely access to key fertilisers when they need them.”

UREA: Higher Sales Supported Through Coordinated Domestic Output and Imports

Urea sales during April–December 2025 increased 3.8% to 31.16 million tonnes, compared to 30.02 million tonnes in the corresponding period last year. Domestic urea production during the period stood at 22.44 million tonnes, while imports rose 85.3% to 8.00 million tonnes, supporting higher sales and reinforcing availability during peak crop nutrition months of the fertiliser year

DAP: Import Support Sustains Availability Amid Moderated Offtake

DAP production during April–December 2025 was recorded at 3.03 million tonnes, reflecting a 3.9% decline compared to the previous year, while imports increased 45.7% to 5.95 million tonnes. Sales during the period stood at 8.00 million tonnes, compared to 8.33 million tonnes in the corresponding period last year, with import volumes contributing to sustained phosphatic nutrient availability despite moderated offtake.

MOP: Steady Sales Supported by Import Availability

MOP imports during April–December 2025 stood at 2.14 million tonnes, compared to 2.76 million tonnes in the corresponding period last year, while sales increased 5.3% to 1.77 million tonnes, supporting potassic nutrient availability across cropping requirements during the fertiliser year to date.

SSP: Indigenous Phosphatic Supply Records Higher Production and Sales

Single Super Phosphate (SSP) production increased 10.3% to 4.43 million tonnes during April–December 2025, while sales rose 13.1% to 4.71 million tonnes, compared to 4.17 million tonnes in the previous year. The combined growth in production and sales reflects the continued role of indigenous phosphatic fertilisers in supporting diversified nutrient availability.

Dr. Suresh Kumar Chaudhari, Director General of FAI, said,

“The evolving nutrient mix reflected in the data underscores a gradual shift towards more balanced fertilisation practices.” Nitrogen continues to account for a significant share of fertiliser use, while steady utilisation of phosphatic, potassic and complex fertilisers points to increasing alignment between nutrient application, crop requirements and soil conditions. This progression reinforces the importance of sustained focus on balanced nutrient management as part of long-term agricultural productivity and soil health objectives.

Between April and December 2025, the fertiliser sector demonstrated a mixed performance across production, imports, and sales, reflecting strategic efforts to balance domestic output with import support. Urea production declined slightly by 3.2% to 22.44 million tonnes, but a significant 85.3% rise in imports (8.00 million tonnes) helped achieve higher overall sales of 31.16 million tonnes, highlighting the role of imports in supplementing domestic supply. DAP production fell by 3.9% to 3.03 million tonnes, while imports increased by 45.7% to 5.95 million tonnes, ensuring phosphatic fertiliser availability despite a 4.1% drop in sales. MOP imports decreased by 22.4% to 2.14 million tonnes, yet sales grew modestly by 5.3% to 1.77 million tonnes, showing calibrated import management. NP/NPK production rose by 13.1% to 9.27 million tonnes, with imports surging 121.8% to 3.29 million tonnes, supporting stable sales of 11.74 million tonnes and promoting balanced nutrient use. SSP production grew 10.3% to 4.43 million tonnes, driving a 13.1% increase in sales to 4.71 million tonnes, reinforcing the importance of indigenous phosphatic fertilisers in the domestic market. Overall, the data underscores a strategic combination of domestic production and imports to maintain supply stability and support agricultural needs.

As fertiliser planning continues through the remainder of the Rabi season, sustained focus on aligning nitrogen, phosphatic and potassic nutrients with crop and soil needs will remain central to ensuring efficient fertiliser use.

The Association reiterated that coordinated production planning, calibrated imports and the strengthening of indigenous nutrient options together support the broader objective of balanced fertilisation. FAI will continue to engage with stakeholders across the value chain to promote evidence-based nutrient management practices that enhance soil health, improve nutrient use efficiency and support sustainable agricultural productivity.

Leave a Reply